Procedures and instructions relating to restructuring are somewhat intricate therefore it is necessary for the branch auditor to know the guidelines issued. As part of the continuing measures to enhance regulatory scrutiny over mounting non performing assets NPA and its resultant strain on the Indian banking system th. Answer 1 of 5. On approval a detailed sanction of the CDR scheme is made available to the consortium membersBank according to which the advance is restructured. BIFR cases are not eligible for restructuring under the CDR. Banks also rework on stressed loans. It implies that a standard account on restructuring for reasons other than change in DCCO would be immediately classified as sub-standard on restructuring as also the non-performing assets upon restructuring would continue to have the same asset classification as prior to restructuring and slip into further lower asset classification categories as per the extant asset. The Reserve Bank of India RBI issued guidelines for loans restructured by non-banking finance companies NBFCs on 23 January 2014. One of the main features of the restructuring under CDR system is the provision of two categories of debt restructuring under the CDR system. The category 1 CDR system will be applicable only to accounts classified as standard and sub-standard.

As part of the continuing measures to enhance regulatory scrutiny over mounting non performing assets NPA and its resultant strain on the Indian banking system th. One of the main features of the restructuring under CDR system is the provision of two categories of debt restructuring under the CDR system. They have an amount of about 500 cr. 61 Treatment of standard accounts restructured under CDR. Upgradation of Loan Accounts Classified as NPAs. It is a Spinal cord for the 525 scheme of RBI. Accounts which are classified as standard and sub-standard in the books of the creditors will be restructured under the first category Category 1. Legal Basis CDR a non-statutory mechanism is a. On approval a detailed sanction of the CDR scheme is made available to the consortium membersBank according to which the advance is restructured. Further under JLF and CDR mechanism the restructuring package should also stipulate the timeline during which certain viability milestones eg.

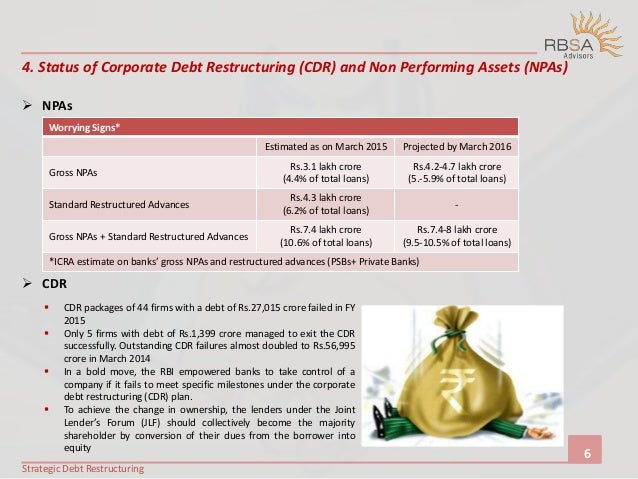

The CDR mechanism will cover only multiple banking accounts syndication consortium accounts of corporate borrowers with outstanding fund-based and non-fund based exposure of Rs10 crore and above by banks and institutions. What is NPA in RBI. Legal Basis CDR a non-statutory mechanism is a. A rescheduling of the installments of principal alone at any of the aforesaid first two stages would not cause a standard asset to be classified in the sub-standard category and reschedulement of installments of principal at the third stage refer to above would not cause sub. Procedures and instructions relating to restructuring are somewhat intricate therefore it is necessary for the branch auditor to know the guidelines issued. Further under JLF and CDR mechanism the restructuring package should also stipulate the timeline during which certain viability milestones eg. Answer 1 of 5. As part of the continuing measures to enhance regulatory scrutiny over mounting non performing assets NPA and its resultant strain on the Indian banking system th. Upgradation is allowed only if the account reaches no overdues status. Banks also rework on stressed loans.

At present asset classification benefit is available in case the restructuring package gets implemented within 90 days from the date of receipt of application non-CDR restructuring. The Reserve Bank of India RBI issued guidelines for loans restructured by non-banking finance companies NBFCs on 23 January 2014. 61 Treatment of standard accounts restructured under CDR. They have an amount of about 500 cr. Earlier As per the RBI guidelines if the restructuring package was implemented within the period of 90 days in case of non CDR accounts and 120 days in case of CDR accounts from the date of application then the pre restructuring asset classification could be retained. If SR - Non-CDR Standard Restructured or SCDR -Standard Restructured under CDR or SSR - Substandard Restructured or DR - Doubtful Restructures is selected under Asset Classification then ONLY column Date from which Restructuring Scheme became effective if any of the. It implies that a standard account on restructuring for reasons other than change in DCCO would be immediately classified as sub-standard on restructuring as also the non-performing assets upon restructuring would continue to have the same asset classification as prior to restructuring and slip into further lower asset classification categories as per the extant asset. I If arrears of interest and principal are paid by the borrower in the case of loan accounts classified as NPAs the account should no longer be treated as non-performing and may be classified as standard accounts. Indian banks have asked the Reserve Bank of India RBI to announce proper guidelines on the classification of restructured assets particularly for cases in which repayments are regular under the revised schedule. It has been decided that promoters sacrifice and additional funds brought by them should be minimum of 20 per cent of banks sacrifice or 2 per cent of the.

Upgradation is allowed only if the account reaches no overdues status. One of the main features of the restructuring under CDR system is the provision of two categories of debt restructuring under the CDR system. BIFR cases are not eligible for restructuring under the CDR. Procedures and instructions relating to restructuring are somewhat intricate therefore it is necessary for the branch auditor to know the guidelines issued. Earlier As per the RBI guidelines if the restructuring package was implemented within the period of 90 days in case of non CDR accounts and 120 days in case of CDR accounts from the date of application then the pre restructuring asset classification could be retained. Accounts which are classified as standard and sub-standard in the books of the creditors will be restructured under the first category Category 1. Corporate Debt Restructuring CDR mechanism is a voluntary non statutory mechanism under which financial institutions and banks come together to restructure the debt of companies facing financial difficulties due to internal or external factors in order to. I If arrears of interest and principal are paid by the borrower in the case of loan accounts classified as NPAs the account should no longer be treated as non-performing and may be classified as standard accounts. Treatment of standard accounts restructured under CDR. Indian banks have asked the Reserve Bank of India RBI to announce proper guidelines on the classification of restructured assets particularly for cases in which repayments are regular under the revised schedule.